What is Intraday Trading- Meaning and Basic of Day Trading

The Histogram is positive when the MACD Line is above its Signal Line and negative when the MACD Line below its Signal Line. The average gain or loss used in the calculation is the average percentage gain or loss during a back period. The standard uses 14 periods to calculate the initial RSI Value. Here is the list of most used and active Indicators that are used by most of the traders. Vinayak is a passionate financial markets enthusiast with 4+ years of experience.

They have absolutely nothing to do with calculating the fundamentals of a share such as earnings, profit margins, or revenue of the company. Technical intraday indicators can be most effectively used to identify good entry points and exit points for a stock by analysing long term trends. The volume-weighted average price, or VWAP, is a crucial instrument for intraday traders who want to forecast stock price movement. VWAP is the weighted average of the stock price over a specific time, as the name implies. The volume for that specific price candle is used to weigh the stock price.

- While there is no perfect indicator, there are a few that are particularly well-suited for intraday trading.

- The script is customizable where user can select which ever levels they are interested in viewing.

- Therefore, when the stock price comes near any of the bands, there are high chances of price reversals.

- These levels are mostly same for all markets i.e. 2%, 4% , 5%, 10% and 20% of previous day close, crossing which the market activity halts.

The Advance Decline Line is a technical indicator that measures the number of stocks advancing minus the number of stocks declining. It is used to gauge the overall health of the stock market and to identify market trends. The Advance Decline Line can be used in conjunction with other technical indicators to generate buy and sell signals. For example, if the Advance-Decline Line is rising while the price of the stock index is falling, it may be a sign that the market is oversold and poised for a rebound. Conversely, if the Advance-Decline Line is falling while the stock index is rising, it may be a sign that the market is overbought and ripe for a correction. The Advance Decline Line is therefore an important tool for both short-term traders and long-term investors.

In the above image, as you can see, the stock is moving right above the moving average line; this indicates it is in an upward trend. As it breaks the line and starts moving below the moving average line, it indicates that the trend has reversed and the downward trend has started. This is one of the most widely used intraday trading indicators. An indicator is a mathematical calculation that is mostly based on the historic price and volume.

Intraday trading indicators combine volumes and prices to get a reliable source of information on the likely direction of the stock price. Normally, price is an indicator while volumes provide the confirmation to a trend. These trading indicators tell you the profit potential in the midst of market volatility and also give a colour of the underlying momentum of the stock and the market. Active traders in the market use technical indicators most extensively, as they are designed primarily for analysing short-term price movements. To a long-term investor, most technical indicators are of little value as they do nothing to shed light on the underlying business. Depending on your trading strategy and the kinds of trades you wish to perform, you can find indicators that help you more than others.

#6. Super Trend

This enables the user to buy and sell the same number of stocks of the same company on the same day before the market closes. The purpose is to earn profits through the movement of market indices. Time decay is the valuation of premium which is lost with every passing day for which the option exists. Hence, a trader may trade an option by using help from technical indicators.

Exponential moving average is what we suggest for intraday trading. Then, you will find that the stock price rises over the former peak and forms a “nose”. Declines to the original price will happen next, and then the stock price will increase to the level of the first peak. You tend to see this pattern when a bullish to bearish trend reversal is going to happen. Supertrend closely resembles MACD and Moving Averages indicators in its functioning. It makes use of the placement of prices to know the current market trends.

Which is the best indicator for trading?

- Moving average (MA)

- Exponential moving average (EMA)

- Stochastic oscillator.

- Moving average convergence divergence (MACD)

- Bollinger bands.

- Relative strength index (RSI)

- Fibonacci retracement.

- Ichimoku cloud.

Similarly, if the multiplier value is too small, then the occurrence of signals increases. Hence chances of making false trading signals are quite high. If the multiplier value is too high, then a lesser number of signals is made. The right client on the chart will show so many indicators you have selected the Super Trend indicator.

A positive OBV reading suggests that more money is flowing into the security, while a negative reading suggests that more money is flowing out. A running gap is a type of price anomaly that occurs when there is a large difference between the prices of two consecutive days. A running gap is considered to be “running” because the market gaps in the same direction on both days. This indicator indicates a buy signal when it closes below the price and the colour changes to green. On the other hand, a sell signal is made when the Super Trend closes above the price and the colour turns red.

The CCI can be used to identify overbought and oversold conditions in a security. When the CCI reaches an extreme level (either above 100 or below -100), it is considered to be in overbought/oversold territory. The RSI can be used to identify overbought and oversold conditions in a security. When the RSI reaches an extreme level , it is considered to be in overbought/oversold territory. RSI is calculated by taking the average of up to 14 days’ closing prices and dividing it by the standard deviation of those prices. The RSI is limited to values between 0 and 100, with readings below 30 indicating oversold conditions and readings above 70 indicating overbought conditions.

Syrma SGS IPO Review: Should You Bet on This Export Champion?

This is an intraday strategy for NIFTY50 Based First candle High and Low breakout. The strategy takes user inputs for the start and end dates, start and end months, and start and end years, which define the time range to trade. The user can also specify the maximum number of trades to take during the time range and the length of the Exponential Moving Average (… The VWAP indicator is used to calculate the average price weighted by volume. This indicator is designed to automatically draw VWAPs from the highest and lowest points of the last ‘n’ bars.

Which is the most accurate indicator for intraday trading?

RSI (Relative Strength Index)

It is the best momentum indicator for intraday trading; it shows you the overbought and oversold zones of a stock. RSI has two lines, one is 80, and the other is 20.

Let’s start our discussion with the Supertrend indicator that can be used as an intraday trading indicator. This indicator is plotted on the price chart and the current trend can simply be determined by its placement vis-a-vis price. It is a very simple indicator that is constructed with just two parameters- period and multiplier. Anyone good at analyzing market trends and patterns can participate in Intraday Trading.

The ATR is a technical indicator that indicates how volatile a market is. Supertrend is a well-known trend-following indicator that excels at the intraday timeframe. It’s also a trend-following indicator with a reputation for precision and accuracy. Moving averages show the stock’s average price over a certain period. When calculating the average with the EMA, all of the price points are not given equal weightage; instead, the closest ones are given more weight than the far ones. Each indicator has its pros and cons and none of the indicators give results with 100% accuracy.

How do I use Moving Averages on charts for trading?

ELM constantly experiments with new education methodologies and technologies to make financial education effective, affordable and accessible to all. You can use the RVI indicator as a confirmation indicator i.e. in combination with other indicators. Do not trade in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. Do not share of trading credentials – login id & passwords including OTP’s.

When you are trading on small spreads with just a 5-hour time window, every basis point of return that you add makes a big difference to your final tally. These momentum oscillators also range between 0 and 100 and show the extent and the intensity of the momentum of the stock. This is more useful when you are trying to trade a stock that is showing a trend that is divergent with the market as a whole. We strongly believe that “trend” is the best friend of every intraday trader and the ADX indicator aids in determining the strength of the trend.

Due to the fact that ATR is not a direction indicator, it indicates the selling and buying pressure. ATR can signal changes in volatility and serve as a stop or entry trigger. It can assist intraday traders in identifying an entry point and entering the trend at its inception. If the stochastic lines are above 80, the market is overbought, indicating a downtrend. Average True Range is a technical analysis indicator that measures volatility was developed by J. He originally developed ATR for Commodities, but it is used by most of the traders for stock and Indices.

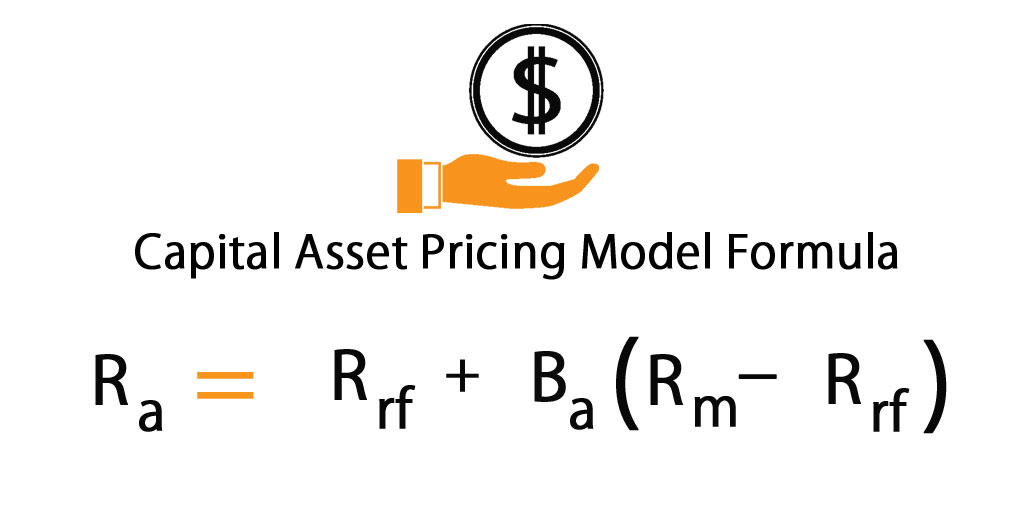

It shows the relationship between two moving averages of Price of security. MACD turns two trend-following indicators, Moving Average into a momentum oscillator by subtracting the longer moving average from the shorter moving average. The moving average indicator can be used best indicators for intraday trading to identify trends as well as trend reversals. The average directional index is a technical indicator that is used to measure the strength of a security’s trend. It is calculated by taking the positive and negative directional indicators and averaging them together.

Types of Technical Indicators

You can say that price movement is directly proportional to volume. On Balance Volume indicator and Chaikin Oscillator are some of the types of volume indicators. Please do not share your online trading password with anyone as this could weaken the security of your account and lead to unauthorized trades or losses. This cautionary note is as per Exchange circular dated 15th May, 2020.

Which indicator has highest accuracy?

The STC indicator is a forward-looking, leading indicator, that generates faster, more accurate signals than earlier indicators, such as the MACD because it considers both time (cycles) and moving averages.

While there is no perfect indicator, there are a few that are particularly well-suited for intraday trading. These indicators can help traders identify opportunities and make informed decisions about when to enter and exit trades. Each index is purposefully designed to evaluate the market in different time frames to discover underlying trends. If short-term averages are exceeding the long-term averages, it indicates a bullish market trend. Traders may take a buy call with specific strategies like stop-loss either at the long-term moving average or retracement support and vice versa.

Contrarily, when there is minimum movement in stock price, the bands contract. Also Most Important this indictor works well in sideways markets, but fails in a trending market. You should note that common gaps are not placed in the patterns of prices. All they do is represent a place where the price of a stock has gapped.

It helps in predicting the future price of the stock, identifying entry & exit points, etc. Some of the best technical indicators for intraday trading are Volume, Moving Averages, Relative Strength Index, and Bollinger Bands. Do you know that technical analysis has many indicators to guide us but all of them are not suited for intraday trading! Yes, some particular technical indicators are best suited for traders who want to square off their position within a day. MACD is calculated by subtracting the 26-day exponential moving average from the 12-day exponential moving average. MACD establishes the relationship between two moving averages of a share’s price.

Which is the best indicator for trading?

- Moving average (MA)

- Exponential moving average (EMA)

- Stochastic oscillator.

- Moving average convergence divergence (MACD)

- Bollinger bands.

- Relative strength index (RSI)

- Fibonacci retracement.

- Ichimoku cloud.