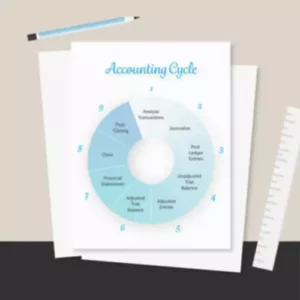

By harnessing the power of technology, client bookkeeping solutions offer a level of efficiency and accuracy that manual bookkeeping simply cannot match. In today’s fast-paced business landscape, efficient financial management is non-negotiable. Embracing client bookkeeping solutions can revolutionize the way you handle finances, propelling your business towards unprecedented growth and success. From streamlining invoicing and expense tracking to gaining valuable insights through real-time financial data, the impact of implementing these solutions is profound. Say goodbye to tedious manual bookkeeping and welcome an era of enhanced accuracy and time-saving automation.

- We have a team of experts who are trained to ensure your financials are in order, so you can focus on what matters most – running your business.

- We strive to learn about your pain points and find practical ways to improve efficiency, streamline accounting processes, and save money.

- If you want your business to save time and money then, yes, you should consider hiring a bookkeeping service.

- Embracing client bookkeeping solutions can revolutionize the way you handle finances, propelling your business towards unprecedented growth and success.

- A bookkeeping service does more than just record payables and receivables, or manage payroll services, they guarantee the security, scalability, and success of your business.

- A good bookkeeping solution should come with reliable support and training resources.

The Posting Requirements page provides access to State and Federal posters and posting requirements for businesses. Human Resources – Our knowledgable, professional HR partners go the extra mile to ensure that you and your business are taken care of, whether it’s providing a full range of HR

support or helping with a single challenge. Insurance – Our insurance brokerage partners are focused on serving a business owner’s Workers Compensation and Disability Insurance needs.

SERVICES

The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence. We use product data, strategic methodologies and expert insights to inform all of our content and guide you in making the best decisions for your business journey. Ideally, you want to focus on those who have accounting technology certifications as well as specific competencies in your industry or core compentencies. Whether you want to get a business loan, answer an auditor, or simply design next year’s budget and business plan, you need the assistance of a full-charge bookkeeper.

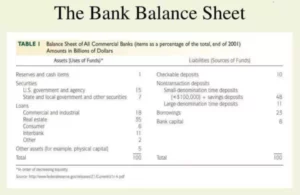

Payroll Solutions in partnerships with other professional service organizations, provides a full service solution to accommodate our clients payroll related needs. Our Bookkeeping Team managers develop your Bookkeeping Team member’s bookkeeping skill and enable them to manage your clients’ bookkeepers. Our Bookkeeping with QuickBooks Online Guide details our bookkeeping service process. The Guide presents our daily, weekly, monthly, and annual bookkeeping policies, procedures, and checklists using QuickBooks Online.

Risk & compliance management

Additionally, some solutions offer in-person training sessions or the services of a dedicated account manager, which can be invaluable for businesses that require more hands-on assistance. With hundreds of options, however, it can be daunting to sort through them all and find the best service for your business. We’ve analyzed the best bookkeeping services to help you find the right solution quickly and easily. Forbes Advisor selected these services based on their service options, pricing, customer service, reputation and more.

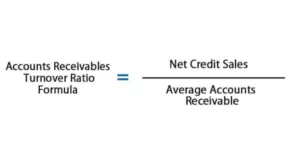

The value of this is immeasurable as it insulates your business from many costly and dangerous risks. And this is where we bring in the third prong of the bookkeeping service, the controller. The controller increases the company’s overall bookkeeping solutions financial accountability and checks and balances. A controller reviews the bookkeeper’s ledger for accuracy while also maintaining the integrity of the accounting data file in the future so that adjustments can’t be made without approval.

ONESOURCE support

It’s time to unlock the true potential of your business with client bookkeeping solutions. Effective training and ongoing support are fundamental components of a successful client bookkeeping solution implementation. Investing in comprehensive training programs for staff members who will be using the software is essential for maximizing its benefits and ensuring proficient utilization. This may involve formal training sessions, online resources, and access to user forums where employees can seek guidance and share best practices. The charts of accounts can be easily set up by the professional accountant

to maintain proper GL, while the AP and AR modules work fluidly with the accounts

to post appropriate transactions and journal entries. The included CheckWriter function

supports online banking, including bill payments and fund transfers, while allowing

customization of check layouts and printing of deposit slips.

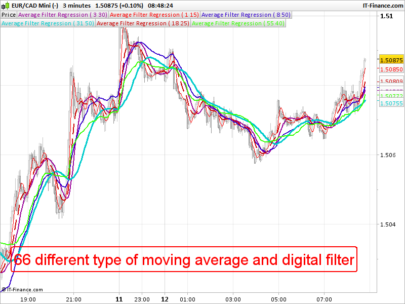

Additionally, providers that prioritize ongoing innovation and product development can offer businesses the assurance of staying ahead of the curve in an ever-evolving technology landscape. Reporting & Management Functions — 3.5 Stars

Each of the modules contains reporting options specific to that area, including

AP and AR aging, customer activity reports, cash flow snapshots, and budgeting

functions. If using

the hosted version of the system, CBS ASP, clients access the program by logging

into the accounting firm’s secure portal using their web browser. This

ensures that the client is always using the most current version, and it gives

the accounting firm total direct access to the client’s bookkeeping system

and all data. The mission of CAS is to help you as a CPA become more in tune with your client’s finances throughout the year, which can in turn help ease the annual tax filing process.

Document management

They

combine the right product and coverage for your business, including “pay-as-you-go” payment options. You use the Guide to direct and manage your client’s bookkeeper or your Bookkeeping Team members performing their bookkeeping. Securely store and easily access your passwords and financial documents from any device at any time. Find all the help you need, right here — including technical support, training, and advice from other Thomson Reuters Onvio customers like you. For pricing, we considered whether a service offers a free trial or a free version of its software as well as the affordability of its lowest and highest price tiers.

- In the rapidly evolving world of finance and technology, staying informed about the top solutions on the market is crucial for businesses seeking to streamline their financial processes.

- User-friendliness and training requirements are also crucial considerations, as seamless adoption and utilization of the software are essential for maximizing its benefits.

- Increase profits, strengthen client relationships, and attract new clients with software and support options that suit every payroll need.

- Get anytime, anywhere online access to CS Professional Suite and select Microsoft® products in the cloud.

- When you become our client, we’ll become a valuable resource for clear and accurate financial information that will contribute to the success of your business.

- The e-mail alerts to the accountant

also provide a safety mechanism by keeping the professional aware of certain

activities.